Introduction

GuestWisely’s Accounting Reports offer essential tools for analyzing and interpreting the financial data managed within your accounting system. These reports are designed to help you assess your business’s financial health, increase revenue efficiency, monitor expenses, and simplify your accounting workflows.

In the Solutions > Accounting section, you’ll find the following reports:

Expense Report

Revenue Report

Tax Report

Commission Report

Profit & Loss Report

Each report provides detailed insights into a specific area of your finances, enabling you to make informed, data-driven decisions and maintain a clear picture of your financial performance, as shown below:

This tutorial will walk you through each report, showing you how to generate, filter, and analyze the key data to support more effective property management.

Accounting Reports are key component of the Accounting feature. Learn more about the Accounting module here.

Viewing Modes

Standard Format

This is the default layout provided by the system. It automatically organizes all financial data from your workflow into straightforward, industry-standard categories. Whether you’re a Reservation Manager or an Accountant, this format offers an easy-to-understand overview of your finances.

Customized Format

The customized format reflects the specific categories you’ve set up in the Organizer. Your reports will display expense types grouped according to the custom structure you've defined, allowing you to tailor the level of detail - from simple summaries to in-depth breakdowns - to suit your needs.

The primary distinction between these two formats is how Property Management Expenses are displayed:

Standard Format: Expenses are categorized by Expense Types.

Customized Format: The Property Management Expenses section is removed, and expenses are grouped under Expense Categories instead.

For a full list of available Expense Categories and Types, refer to the Organizer tab in the Accounting section.

Here is an example illustrating the difference between the two formats:

Filter & Display

The Filter function works the same across all Accounting Reports.

Filter by Property – All properties are selected by default, but you can apply filters to generate a report for a specific property or group of properties.

Display Mode – Choose between Standard Format or Customized Format.

Year – Select the year for annual data generation.

Format – View the report By Month or By Quarter.

Calculation Method – Choose between By Check-in Day or Pro-rata by Day.

Note: The Tax Report and Commission Report do not include the Display Mode filter.

Line-item Breakdowns

Where applicable, each line item in a report includes a plus icon that reveals a detailed breakdown of the underlying revenue or expense types. For example, clicking the icon next to Channel Fees will show individual charges from platforms like Airbnb, Booking.com, and Vrbo.

Tip: Click to expand all breakdowns before downloading or emailing your report.

Expense Report

The Expense Report consolidates all expenses, including booking-related charges from the Booking Editor and manual entries from the Expense Manager. Use dynamic filters and switch between Standard and Customized views to organize data and generate reports that match your workflow.

Expense Report include the below items:

Rent (Income to Owners)

This item reflects the net rental income, along with any extra occupant charges, passed to the owner after the channel fee is deducted.

For managed properties, the amounts under Net Rent and Extra Occupants should be equal in both the Revenue Report and the Expense Report.

Channel Fees

This item indicates the channel fees charged by the sales channel. It can apply to both confirmed bookings and canceled bookings, depending on the channel’s policy.

Booking Expenses (for Guest Services)

This item indicates the amount recorded under Booking Expenses.

If any of these expenses are marked as Owner Expense, they will also be reflected under the Guest Services section in the Revenue Report.

Retained Funds (Income to Owners)

If you receive an amount as Retained Funds (e.g., from a cancellation or damage claim) and mark it as Owner Funds, this amount will be passed to the owner. It will be displayed under the Retained Funds item in the Expense Report.

Property Management Expenses

This item indicates Property Management Expenses tied to a specific property, recorded through the Expense Manager.

If any of these expenses are marked as Owner Expense, they will also be reflected under the Property Management Services section in the Revenue Report.

Business Overhead

This item indicates expenses related to business operations, not property-specific, such as office rent, salaries, utilities, insurance, general marketing, etc.

Miscellaneous

This item indicates Property Management Expenses not tied to a specific property, recorded through the Expense Manager.

Revenue Report

The Revenue Report offers a comprehensive view of your income. It covers bookings, guest services, owner-related transactions, and other revenue streams. It automatically accounts for applicable taxes and deductions such as channel fees and commissions, helping you manage revenue effectively and maximize profitability. Revenue Report include the below items:

Below you can find a more detailed breakdown of each item in the Revenue flow table:

Rent

This item represents the total rental amount paid by guests for bookings, also known as the gross rent, which includes any channel fees.

Guest Services (Booking Expenses)

These are services (e.g. cleaning, early/late check-in, etc.) paid by guests. If any booking expenses are marked as Owner Expense, they will:

Appear under Guest Services in the Revenue Report.

Appear under the Property Management Service section in the Owner Statement.

Property Management Services

If any Property Management Expenses (e.g., maintenance) are marked as Owner Expense:

They will appear in the Property Management Expenses section of the Expense Report.

They will also be reflected in the Property Management Services section of the:

Revenue Report

Owner Statement

Commissions

This item represents the commission earned from bookings according to your Commission settings. It can also be allocated to Retained Funds.

Retained Funds

This item represents the amount received as Retained Funds:

For confirmed bookings: Charges collected from the guest for any damages.

For canceled bookings: Cancellation penalties charged to the guest. These will be broken down into the net cancellation amount and channel fee (if applicable).

Miscellaneous

This item includes any revenue not directly related to bookings.

Tax Report

The Tax Report in GuestWisely displays taxes collected by tax type as part of your rental business, giving you a clear view of how much you need to pay to the tax authority. You can view totals by month, quarter, or year based on your needs.

Commission Report

The Commission Report provides a straightforward view of commissions earned from rental-related income. While the Profit & Loss Report includes commission amounts along with overall operating profit, the Commission Report remains useful for a quick and simple breakdown of commissions by property, property group, or portfolio.

Use this report when you need a clear, focused summary of commission earnings without additional financial details.

Profit & Loss Report

The Profit & Loss (P&L) Report is an essential financial statement that provides an overview of your business's revenue, expenses, and net profit over a specified period. It helps you analyze financial performance and make informed business decisions.

Profit & Loss Report Sections

Revenue (Same as Revenue report)

Expenses (Same as Expense report)

Operating Profit (Total Revenue - Total Expenses = Net Profit (or Loss))

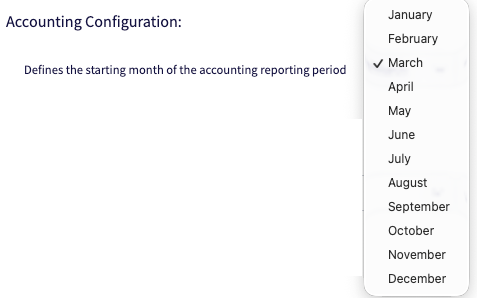

You can now use the the Accounting Configuration setting to define the starting month of your accounting reporting period, which determines how financial data is grouped and reported throughout the year. By selecting a start month (for example, March), all reports will follow that accounting cycle rather than the calendar year.

You can find this feature under your Profile > Special Preferences > Accounting Configuration (scroll towards the bottom of the page).

Understanding Tax Treatment in Reports

Tax Tracking

GuestWisely automatically tracks tax payments received on revenue and tax payments made on expenses based on your tax settings.

Revenue & Expense Reports: Provide a detailed breakdown of tax amounts. They display all taxes at the line-item level to provide detailed insights.

Profit & Loss Report: Displays tax information in aggregate form. It shows taxes respectively at the bottom of the revenue and expense sections of the report, as it befitting for a P&L statement

Any report can be viewed without taxes by clicking the “Remove taxes” checkbox at the top of each report. This action will not only remove taxes from view but also exclude them from the calculations altogether.

Tax Reconciliation

When filing your VAT return (or equivalent tax in your region), you can reconcile tax payments as follows:

If you owe tax, record it as an expense in the Expense Manager.

If you have a tax credit, enter it as revenue in the Revenue Manager.

Apply the same method for business taxes, corporate taxes, interest, or amortization costs.

In this way, your Operating Profit on the Profit & Loss Report will become a Net Profit before income tax.

Remember, we are technologists. Your accounting is always your responsibility.

Accounting Reports are key component of the Accounting feature. Learn more about the Accounting module here.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article