Introduction

Welcome!

An integrated accounting system saves time and ensures accurate, organized financial records—crucial for compliance and smart business decisions.

GuestWisely is one of the few Property Management Software (PMS) providers in the vacation rental industry with a built-in accounting solution that’s fully integrated with the rest of the platform.

From tracking revenue and managing expenses to generating reports, GuestWisely’s accounting is comprehensive. It helps property managers streamline their entire financial operation with tools purpose-built for the vacation rental industry, while also integrating with QuickBooks and Xero for those with additional needs.

Because of this, there’s a lot to explore to ensure you get the most out of the features and benefits available.

This tutorial provides a clear overview of GuestWisely’s accounting tools and sets the stage for making the most of our in-depth accounting tutorials.

Let’s dive in!

Integrated Accounting

GuestWisely’s accounting structure consists of two main areas:

Tools: used to create, manage, and manipulate data.

Reports: these allow you to view, analyze, and gain insights from data generated in your Accounting tools and Booking Editor booking activity.

This demarcation generally makes it easier to learn how the different solutions contained within work and how they interact with each other.

Accounting Tools

Here’s a screenshot of the top of the accounting dashboard. The widget in the top right lets you switch between the Tools and Reports sections. Each tab displays the features or solutions available in that section. Numbered annotations match the explanations provided below.

Within the Accounting Tools section, you’ll find:

Organizer

The Organizer includes both a Revenue Organizer and an Expense Organizer, where you define how your financial data is structured. Setting this up early, based on your preferences, will save time and streamline your use of the GuestWisely Accounting suite.

Please refer to the full Accounting Organizer tutorial here for more details.

Expense Manager

The Expense Manager in GuestWisely makes it easy to track and manage all expenses across your vacation rental business. Whether it's a one-time charge or a recurring cost, it streamlines your workflow and improves financial reporting—saving you time and effort.

Booking Expenses are automatically pulled from booking activity within the system and usually require little or no manual input.

Other Expenses refer to external costs that need to be imported or entered manually.

With intuitive tools for adding, editing, and bulk uploading expenses—plus seamless integration with Owner Statements and Accounting Reports—the Expense Manager helps you maintain accurate financial records with ease.

Check out the full tutorial here.

3. Revenue Manager

GuestWisely's Revenue Manager module gives you full control over your income streams by simplifying the tracking and managing of diverse revenue sources. Whether you're dealing with income from bookings, commissions, or other sources, the Revenue Manager allows you to seamlessly manage, allocate, and track revenue, ensuring accuracy and efficiency.

Check out the full tutorial here.

Cashflow Manager

The Cash Flow Manager helps you efficiently track expenses and manage outstanding balances. Distinguishing between Booking Expenses and Other Expenses, it allows you to:

Monitor total expenses.

Record your outgoing payments.

Track outstanding cash liabilities.

It also offers clear summaries of paid and unpaid amounts, ensuring efficient financial management and accurate records.

Check out the full tutorial here.

Payout Dashboard (Owner Remittance Dashboard)

The GuestWisely Payout Dashboard streamlines owner remittance payments, by providing a centralized view of trust account balances, required retainers, and remittances, ensuring seamless cashflow tracking.

By integrating with QuickBooks/Xero, the Payout Dashboard can further automate and simplify financial workflows, thereby reducing substantially more manual effort, for instance, by processing all your remittances simultaneously at the push of a button, if you so choose.

Whether managing payments manually or leveraging automation, the Payout Dashboard enhances efficiency and transparency in owner remittance processes.

Check out the full tutorial here.

Lock Settings

GuestWisely’s Lock Settings safeguard your financial data by preventing changes to already finalized owner statements and accounting records. This is an essential feature in any professional accounting system. With customizable lock periods (1–12 months) and flexible options - Auto-Lock, Manual Lock, or Unlocked - GuestWisely’s lock logic gives you full control over data integrity, ensuring accuracy and efficiency in your financial processes.

Check out the full tutorial here.

Accounting Reports

You can find all these reports explained in our Accounting Reports tutorial here.

For now, here’s brief introduction to each:

Expense Report

The Expense Report provides a comprehensive view of all your expenses in one place, combining Booking Expenses from the Booking Editor with all Other Expenses tracked in the Expense Manager. With dynamic filters and flexible formatting, including Standard and Customized views, you can generate professional, tailored reports that fit your vacation rental management needs effortlessly.

Revenue Report

The Revenue Report offers a clear breakdown of all income sources, including bookings, guest services, owner transactions, and additional revenues. It tracks earnings, applies relevant taxes, and accounts for deductions for things like channel fees and commissions, giving property managers full financial visibility of their revenue.

3. Tax Report

The Tax Report tracks taxes collected by type, providing a clear view of amounts due to tax authorities.

Commission Report

The Commission Report highlights rental-related commissions by property, group, or portfolio.

Profit & Loss Report

Along with a well-built Owner Statement solution, a high-performance Profit & Loss Report is what makes the difference between a set of tools versus a complete accounting solution. This is why many PMS systems that have some accounting lack the all-important Profit & Loss component.

GuestWisely’s Profit & Loss Report is an essential financial statement that provides an overview of your business's revenue, expenses, and net profit over a specified period, all in one place. A Profit & Loss report is absolutely essential for analyzing financial performance and making informed business decisions, and with GuestWisely, your Profit & Loss reports are generated for you automatically.

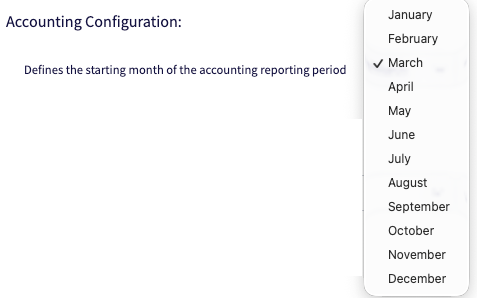

You can now use the the Accounting Configuration setting to define the starting month of your accounting reporting period, which determines how financial data is grouped and reported throughout the year. By selecting a start month (for example, March), all reports will follow that accounting cycle rather than the calendar year.

You can find this feature under your Profile > Special Preferences > Accounting Configuration (scroll towards the bottom of the page).

Trust Accounting

Trust Accounting in GuestWisely is a robust financial management tool that ensures precise tracking of owner funds. It consolidates financial data at the owner level, offering a real-time view of cash flow across your entire portfolio.

Seamlessly integrated with other accounting features, such as the Expense Manager and Payout Dashboard, Trust Accounting provides full visibility of owner balances, retainers, and remittances. It ensures compliance, financial accuracy, and smooth payments through integrations with QuickBooks or Xero, simplifying your accounting workflow.

Trust Accounting is essential for maintaining transparent, organized financial records and streamlining owner payouts.

Please refer to the full Trust Accounting tutorial here for more details.

Owner Statements

Owner Statements and their relation to accounting.

Owner statements are profoundly important. Property owners expect their statements to be timely, accurate, and professional. For property managers without the right tools, meeting these standards is time-consuming, complex, and error-prone.

GuestWisely’s Owner Statement system is highly configurable and fully integrated with the entire PMS ecosystem, including accounting. This allows Owner Statements to be automatically generated, while still giving you full control to review, edit, or intervene when needed.

You can send statements individually, in bulk, or automate delivery entirely. Owners can also access their statements anytime through the GuestWisely Owner Login portal.

Although Owner Statements are part of the Owner Management Solutions area, their content is driven by multiple parts of the system—including Property Settings, Reservation Manager activity, and Accounting entries related to owners. Understanding these areas is essential for getting the most out of Owner Statements.

Please refer to the full Owner Statement tutorial here for more details.

We hope you found this introduction helpful. To fully unlock the power of GuestWisely’s accounting suite, explore our other tutorials—each designed to give you practical insights and strategies for making the most of every feature.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article